Q2 2025 Update: Steel Pricing & Tariffs

An Update on Pricing, Tariffs and Lead Times

I want to share the latest developments in the US Cold Rolled (CR) steel market as we move through Q2 2025. After two straight quarters of pricing stability, volatility has returned and domestic steel prices have dramatically increased due to the steel tariffs implemented in March and April.

Based on March and April’s Domestic steel prices, it is now clear that there will be a price increase on steel pails July 1st. How much? It is still unclear.

Good news, according to Steel Market Update, CR coil prices in the US declined this week for the first time since early February. As of April 8, domestic CR averaged $1,135 per short ton, down $25/st from the prior week. This marks a minor reversal from the massive upward trend driven by the reintroduction of Section 232 tariffs on March 12.

Last week we saw some weakening in steel demand cause by economic uncertainty, which has led to declining steel prices. Our 3Q steel pricing will be finalized in May, but as we have seen, much can change between now and then.

Steel Tariffs: Expansions and Country-Specific Impacts

Additionally, country-specific tariffs remain in play: Canadian and Mexican steel not covered by USMCA exemptions faces a 25% duty, while Chinese steel is subject to multiple overlapping tariffs totaling up to 145%. European Union steel also now faces a 25% tariff, with no exemptions currently in effect.

As reported in my previous tariff update, CSC remains in a good position. The majority of our steel is either sourced domestically or already includes a tariff from previous Section 232 measures, which are not stackable with the new tariffs. We source some steel from Canada, who is luckily absorbing these tariff charges (for now).

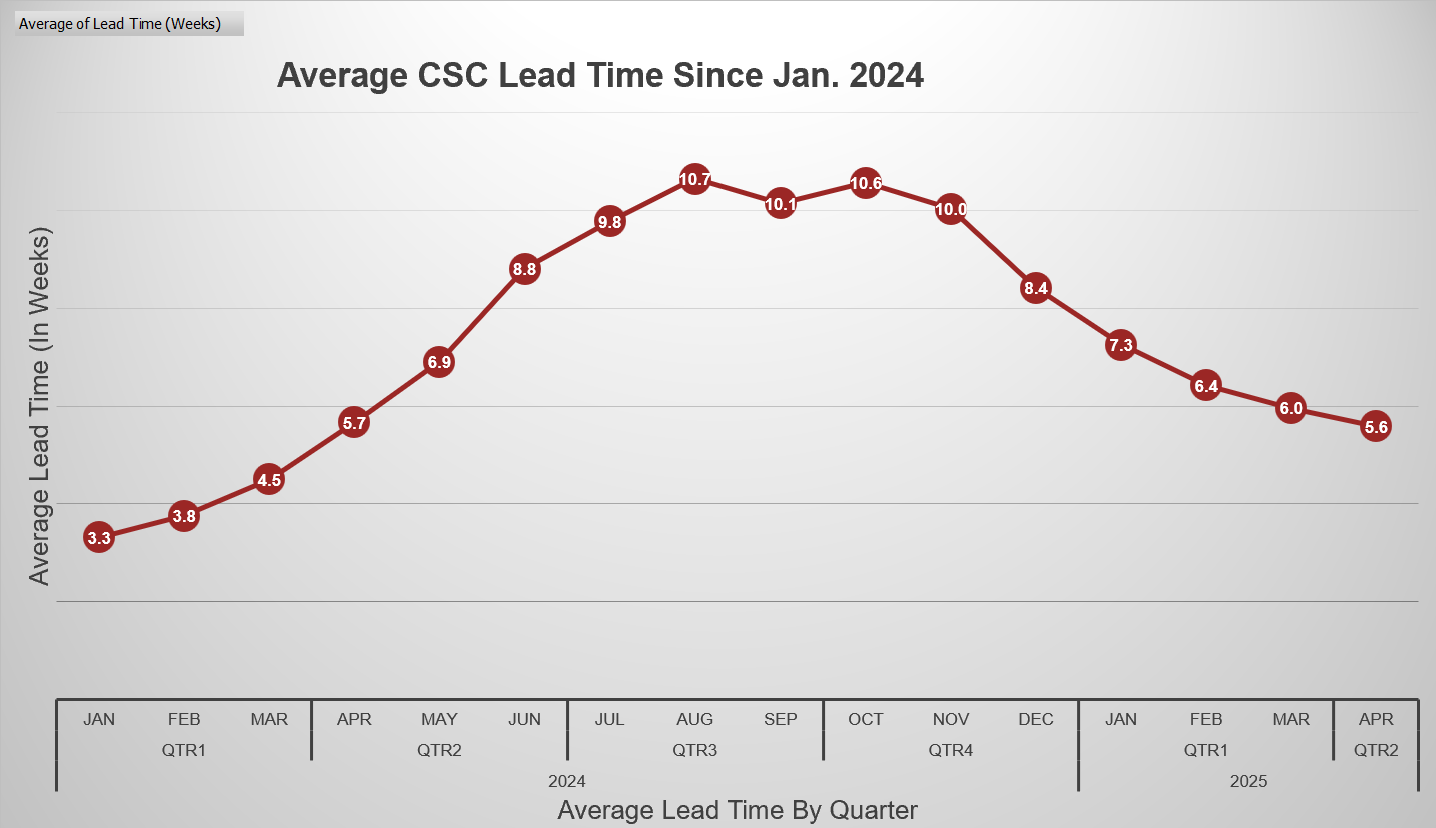

Lead Times Have Stayed Down

For Further Reading:

- Section 232 Tariff Updates: https://www.steelmarketupdate.com/2025/04/11/us-offshore-crc-prices-diverge/

- Market Impact of US Steel Tariffs: Trump Tariffs: The Economic Impact of the Trump Trade War

Thank you for your continued support, and we’ll be in touch with more details as they become available.

If you have any questions about an upcoming pail order, don’t hesitate to contact your sales manager!

Kindly,

![]()

Dan Roether

Vice President of Sales