Updating You on Q12026 Pricing & Lead Times

I wanted to share an update on pricing, lead times, and the steel industry heading into 2026, and we have some good news on multiple fronts.

Steel Prices: Holding Steady

Your CSC steel pail prices remain unchanged for Q1 2026!

While I am happy to report your pricing will not change for Q1, cold-rolled steel prices have climbed significantly in recent weeks. If these trends continue into Q2, they’ll eventually affect pricing adjustments later in 2026.

For now, I highly suggest booking your Q1 orders while pricing remains stable.

According to Steel Market Update, cold-rolled steel just hit a five-month high of $1,070 per short ton, up $30 per short ton just this past week alone. This marks the seventh consecutive weekly increase, and their price momentum indicator is signaling further gains ahead.

We’ll continue monitoring conditions closely, but the outlook suggests this demand could lead to higher prices after the first quarter.

Steel Market Momentum Grows

What’s really interesting right now is the fundamental shift in steel demand we’re seeing across the industry. According to Steel Market Update’s latest analysis, steel is gaining back market share from aluminum in automotive applications.

As CRU’s analysis notes,”Steel remains the dominant automotive material… On a weighted-average curb-weight basis, steel accounts for around 64% of the curb-weight of an internal combustion engine (ICE) light vehicle.” What’s changing is that automakers are reassessing aluminum-heavy designs because of cost and supply constraints. That’s good news for domestic steel producers, but could mean higher prices later on in 2026 due to increased demand.

Domestically, the investment momentum is undeniable. SMU reports that US Steel is restarting a blast furnace in Granite City, Illinois – a facility that’s been idle since 2023. As one Steel Market Update analyst put it, “the domestic market, in US Steel’s judgment, will grow in the near future, justifying the restart.” That kind of capacity decision signals confidence in sustained demand for steel in the US.

NEMO Industries is building a new pig iron facility targeting a 2030 startup, and they’re not doing it on speculation. The company is in “active conversations” with major steelmakers about securing offtake agreements. The message from Mills is clear: they want domestic supply, and they’re willing to commit to it.

Why This Matters to You – And an Update on Lead Times

Here’s the bottom line: the market is anticipating growth in steel demand next year. Mills are investing. Customers are committing to domestic supply. And yes, we’re getting busier as a result and are anticipating higher steel prices later on in 2026.

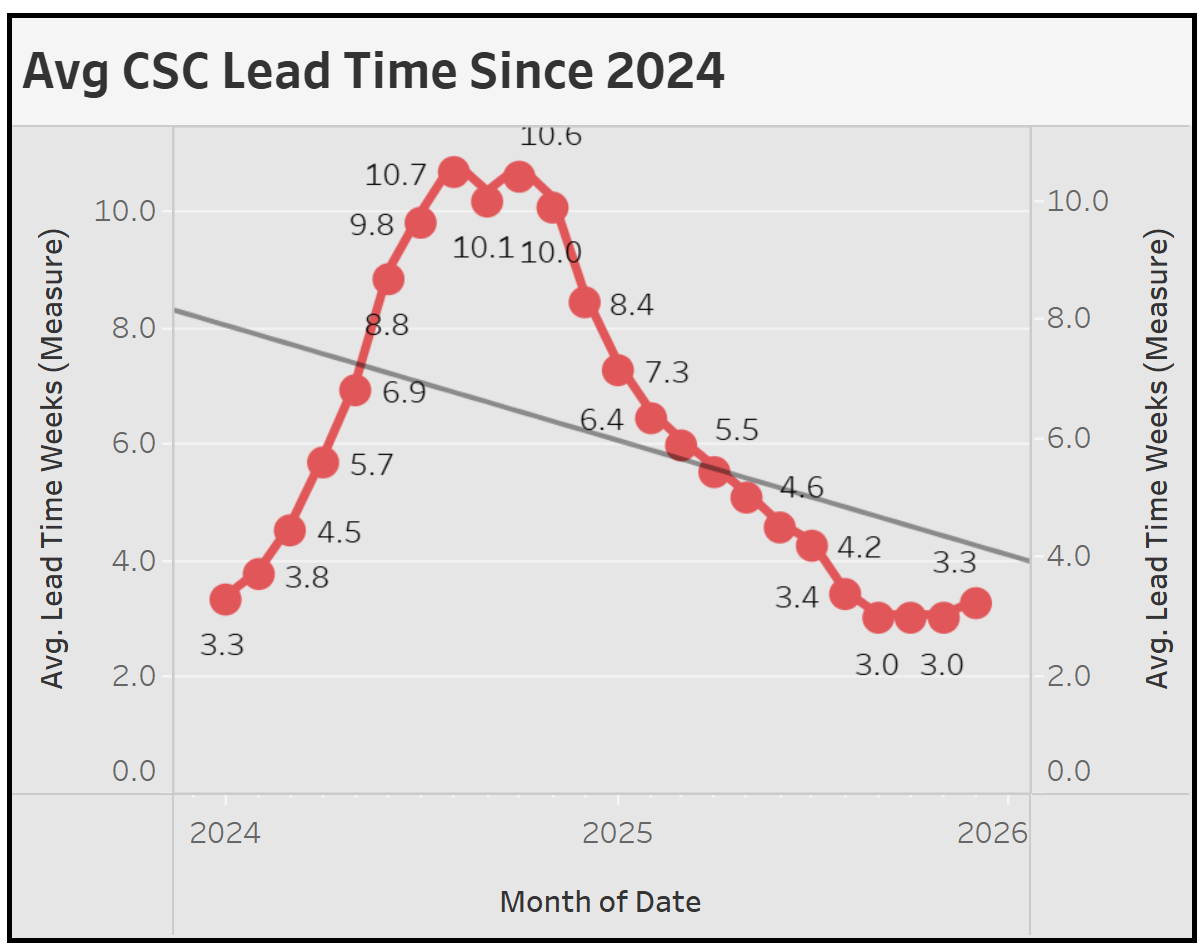

Our current lead times reflect this momentum:

- 3-4 weeks for most orders from our Kilgore, Niles, Peotone, and Quakertown Plants

- Some plants like Kilgore, are seeing increased order flow and minor capacity constraints as volume picks up

We’ve worked hard over the past year to bring lead times down and keep them there. As demand continues to build, we’re carefully managing capacity so we can respond quickly without compromising quality or delivery times.

For Further Reading:

- Cold Rolled Steel Pricing: https://www.steelmarketupdate.com/2025/12/02/smu-price-ranges-plate-stable-sheet-pushes-higher/

- Market Impact of US Steel Tariffs: Trump Tariffs: The Economic Impact of the Trump Trade War

- Steel Market Update: USMCA Review & North American Steel Outlook

- Steel Market Update: CRU – Will Carmakers Switch Back from Aluminum to Steel?

- Steel Market Update: NEMO Industries – Pig Iron Vision Toward 2030 Launch

If you have any questions about an upcoming order, don’t hesitate to contact your sales manager!

Kindly,

![]()

Dan Roether

Vice President of Sales