6 Ways the Steel Industry is Actively Impacting Steel Pails (Q2 2021)

There are 6 major events within the raw steel industry that are currently affecting or will affect the steel pail industry as we head into Q2 2021:

- Section 232 Tariffs Staying In Place

- Steel Prices Increasing (Per Ton)

- Steel Mill Utilization Slipping

- Zinc Demand Remaining Strong

- Lead Times for Steel Staying Extended

- Scrap Prices Staying High

Below I explain these 6 major factors a little more, however I advise you to subscribe to Steel Market Update to see the big picture of the steel industry. A lot of our steel industry news and analysis comes from Steel Market Update, so check them out and make sure you subscribe to their newsletter for even more in-depth updates.

Read on to see 6 steel industry events and how they will affect steel pails moving forward into Q2 2021

Section 232 Tariffs Staying In Place

By far the biggest thing affecting steel pails is the consensus that the Section 232 Steel Tariffs are working and will stay in place. In the short run, these tariffs will in fact keep steel prices high and lead times out — I highly suggest reading more about the tariff’s positive and negative effects on Steel Market Update.

According to Steel Market Update, the Steel Manufacturers Association stated that “The tariffs have resulted in increased investment and modernization of the domestic steel industry,” and that “The report validates how steel tariffs have created jobs and have ensured America’s national security is not jeopardized by structural issues of global excess steel capacity, subsidies and surges in unfairly traded imports.”

First enacted under President Trump’s administration, the Section 232 Tariffs are fairly popular among those in the steel industry, with Kevin Dempsey, president and CEO of the American Iron and Steel Institute saying it’s “abundantly clear that the steel tariffs are working.”

However, keeping foreign steel out of the US market now means that the same demand for steel has to be met by a much smaller domestic steel market. I lay the consequences from this out in the next few sections.

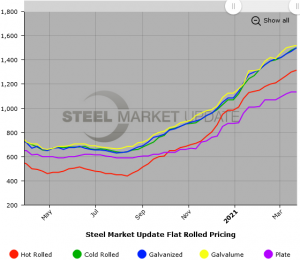

Steel Prices Increasing (Per Ton)

Since May 2020, we’ve watched as steel prices increased every month. This directly affects the steel pail industry, with its biggest material component having almost doubled in its initial cost.

Price increases are inevitable, however, the fact that steel costs about double what it did a year ago is unprecedented. No one who purchases large volumes of steel like us has ever seen anything like this, and that makes it even more difficult when there are no signs of it coming down in any significant way.

This creates an added cost for everyone along the supply chain — something that isn’t good for anyone (except the steel mills in this case).

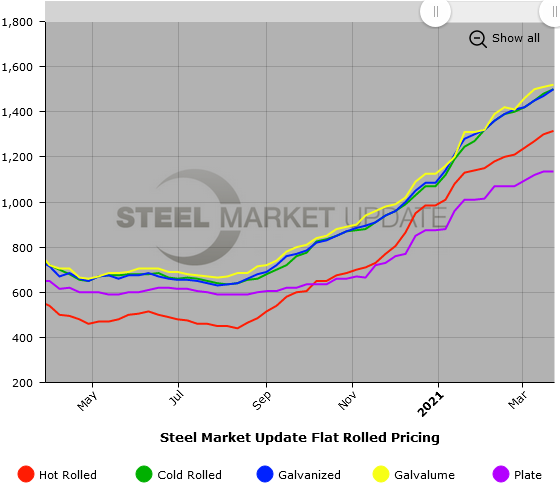

Steel Mill Utilization Slipping

High steel prices aren’t helped by the fact that, according to Steel Market Update, weekly steel production is down around 0.5% compared with their prior week’s numbers.

This means the already fierce competition for our already limited domestic supply of steel is going to ramp up. It’s not a great way to start off the second quarter, and if anything it’s going to even bring lead times or prices back down, its going to be when our domestic steel mills get their utilization numbers up big time.

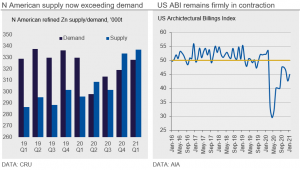

Zinc Demand Remaining Strong

Zinc, a primary material in steel, is also used in several other finished goods.

There’s only so much Zinc to go around, and with the demand for steel and other raw materials so high right now, it’s no surprise steel costs so much and is harder to manufacture right now.

The steel mills can’t begin to use more of their facilities if they themselves can’t get the raw materials on-time or at an affordable price to make the steel. If the demand for Zinc and other components that go into steel stay this high then it’s going to be even more difficult for us to get what we need, when we need it.

Lead Times for Steel Staying Extended

High prices and lower manufacturing turnout is bad enough, but unfortunately, the delays in getting finished steel aren’t going away as we start Q2 2021.

Lead times are staying extended out, but the good news seems to be that they aren’t going to get much worse than they are now.

Scrap Prices Remaining High

While scrap prices are “widely expected to decline in April” the fact that they increased so much in March of this year means that even an April price cut for scrap metal means the price is staying much higher than in years past.

What’s interesting is that, according to Steel Market Update, “although scrap prices are higher than they have been in over a decade, they are still being outpaced by steel prices.” This is certainly a good thing, steel prices right now aren’t exactly cheap, so as we enter Q2 2021, don’t expect to be getting a deal purchasing scrap metal to use instead of newer or brand new steel.

So what does this all mean for steel pails?

All the above-mentioned factors directly impact how manufacturers like us build and ship steel pails.

When the steel mills are late on their deliveries, that makes us have to extend our lead times. Same thing when cold-rolled steel prices literally double, we have to adjust our pricing to compensate for this ridiculous added cost.

As we head into Q2 for 2021, the good news seems to be that the industry is beginning to level off- such as steel prices and lead times extending. So while nothing appears to be dramatically getting better (or worse!) in the foreseeable future, at least we can adapt and work through these current issues moving head.